50-Year Mortgages: A Smart Move or a Long-Term Trap?

50-Year Mortgages: A Smart Move or a Long-Term Trap? Real Numbers Buyers Should See in 2025

By Brent W. Wright, TWG

As home prices stay elevated and mortgage rates remain higher than many buyers expected, more people are looking for creative ways to make the monthly payment work. One idea gaining national attention is the 50-year mortgage — a loan stretched over half a century.

But does it actually help?

Or is it simply a costly long-term commitment?

To answer that, let’s break down how 50-year mortgages work and show real numbers from a $400,000 example so you can see the true impact.

What Is a 50-Year Mortgage?

A 50-year mortgage is identical to a 30-year loan — except the payments are spread out over 600 months, not 360. That makes the monthly payment smaller, but the loan more expensive.

And here’s the crucial part:

50-year mortgages almost always come with higher interest rates.

Lenders take on more risk with extremely long loans, so they typically charge anywhere from 0.4% to 1.0% more than a traditional 30-year fixed.

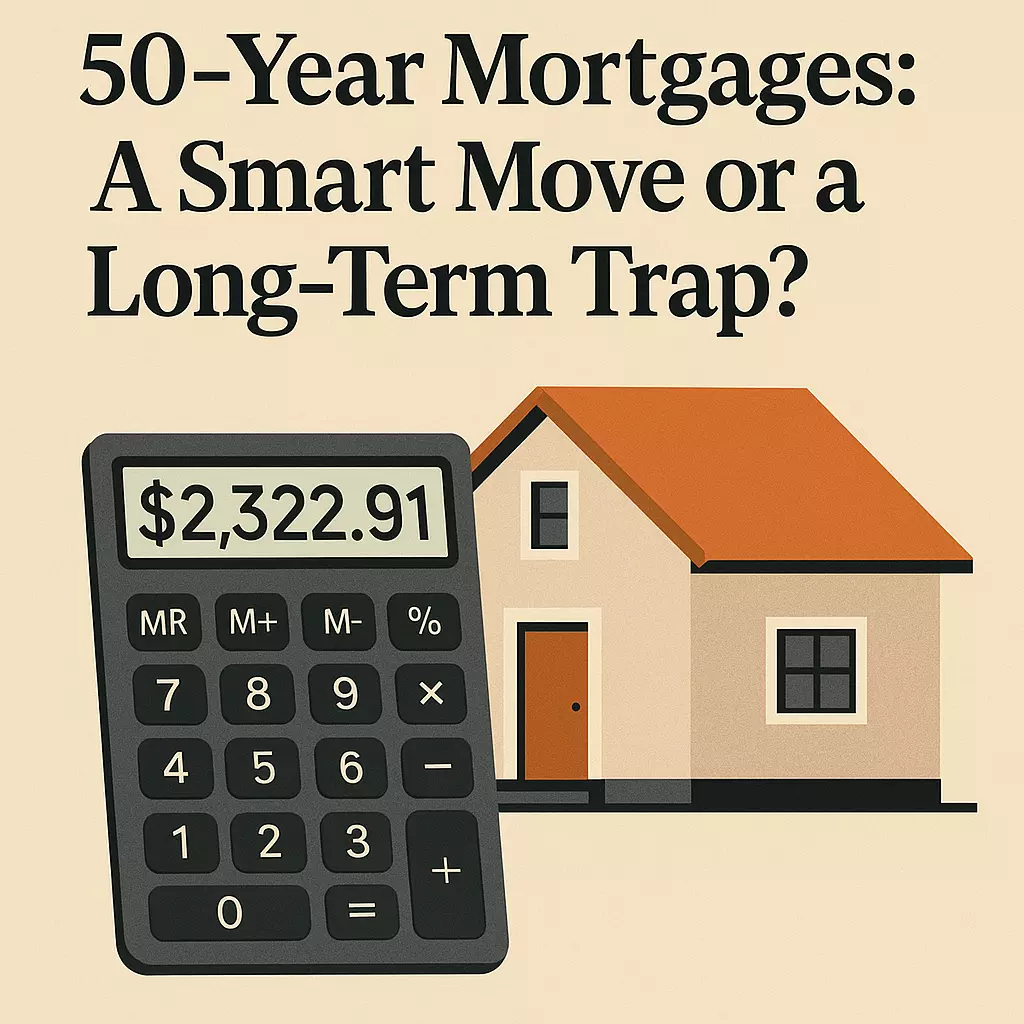

Real Example: $400,000 Loan Comparison

Let’s compare a $400,000 loan at standard 30-year rates vs. a 50-year loan with a slightly higher rate.

30-Year Mortgage

-

Loan Amount: $400,000

-

Interest Rate: 6.25%

-

Term: 30 years

-

Monthly Payment P&I: ≈ $2,462.87

-

Total Interest Paid: ≈ $486,633

50-Year Mortgage

-

Loan Amount: $400,000

-

Interest Rate: 6.725% (about 0.475% higher)

-

Term: 50 years

-

Monthly Payment P&I : ≈ $2,322.91

-

Total Interest Paid: ≈ $993,747

What These Numbers Really Show

✔ Monthly Payment Savings

A 50-year mortgage saves about $140 per month.

That’s not nothing, but…

❌ Total Interest More Than Doubles

A 50-year loan costs roughly $507,000 MORE in interest than the 30-year option.

That means:

You save $140/month but pay over $500,000 extra.

This is why the 50-year concept raises eyebrows among lenders and financial planners.

Why Some Buyers Might Still Consider It

Even though it’s expensive long-term, there are scenarios where a 50-year mortgage may still be useful:

✔ You expect to sell within 5–10 years

Most homeowners never pay off a 30-year loan, let alone a 50-year loan.

If you won’t keep it long, the lifetime interest doesn't matter as much.

✔ You need a lower payment to qualify

A $140 savings per month can help some buyers get approved.

✔ You plan to refinance if rates drop

If rates fall in the future, refinancing into a shorter-term loan could erase the 50-year disadvantage.

✔ Competitive markets

Lower payments might help buyers win against competing offers.

Why Many Buyers Should Be Cautious

❌ Slow Equity Buildup

A 50-year loan barely reduces the principal in the early years.

Even after 5–10 years of payments, you may have built very little equity.

❌ Higher Financial Risk

With so little equity growth, you’re more exposed if home prices stall or decline.

❌ Significantly Higher Interest Rate

Even a half-percent increase makes a huge difference over decades.

❌ Long-Term Debt Into Retirement

A 50-year loan taken in your 30s or 40s could still be active in your 80s or 90s.

Does a 50-Year Mortgage Make Sense in Northwest Indiana?

For NW Indiana — including Portage, Valparaiso, Chesterton, Hobart, and surrounding areas — the picture is mixed.

✔ Local Prices Are Lower

Compared to Chicago, NW Indiana already offers more affordability.

Most buyers here don’t need a 50-year loan to qualify.

✔ Short-Term Buyers May Benefit

Many local buyers move within 7–12 years.

For them, the long-term interest cost may never materialize.

❌ Move-Up Buyers Might Get Stuck

Slow equity buildup can delay selling and upgrading to a larger home.

❌ Availability Will Be Limited

Even if the policy moves forward, only certain lenders will offer 50-year products.

Brent’s Bottom Line

A 50-year mortgage does lower the monthly payment — but only slightly.

In exchange, the total borrowing cost becomes dramatically higher.

**For short-term buyers, it can be a workable strategy.

For long-term owners, it’s usually a poor financial choice.**

What matters most is understanding your timeline, your financial goals, and whether the short-term payment relief outweighs the long-term cost.

Have Questions or Want a Comparison for Your Price Range?

If you’d like a personalized breakdown, Brent W. Wright at TWG can help you compare:

-

30-year vs 40-year vs 50-year options

-

How payment changes with rate fluctuations

-

What makes the most sense for your goals

-

Strategies to improve affordability without adding decades of debt

📞 Contact: Brent W. Wright 219.406.7195

🌐 TWG

📍 Northwest Indiana Real Estate

Categories

Recent Posts

GET MORE INFORMATION